The Multi-Currency Payment Challenge

Before comparing platforms, let's establish what multi-currency eCommerce actually requires.Beyond Simple Currency Display

Many merchants think multi-currency just means showing prices in different currencies (£50 GBP instead of $65 USD). But true multi-currency commerce involves complex considerations: Customer expectations per region: US customers: Credit cards (Visa, Mastercard), digital wallets (Apple Pay, Google Pay), buy-now-pay-later (Affirm, Afterpay) UK customers: Credit/debit cards, PayPal, digital wallets, bank transfers (faster payments) Australia customers: Credit cards, PayPal, Afterpay (extremely popular), POLi (bank transfer) EU customers: Credit cards, PayPal, SEPA direct debit, local methods (iDEAL in Netherlands, Sofort in Germany, Bancontact in Belgium) Canada customers: Credit cards, digital wallets, Interac (debit network) The complexity: Supporting one payment method is straightforward. Supporting 15+ payment methods across 5+ currencies while optimizing authorization rates and minimizing fees requires sophisticated gateway capabilities.The Hidden Costs of Payment Processing

Transaction fees are just the beginning. Total payment cost includes:| Cost Component | Typical Impact | Example at $10M Revenue |

| Base transaction fee | 2.5-3.5% | $250K-$350K |

| Currency conversion markup | 1-3% on FX | $30K-$90K |

| Failed authorization cost | Lost revenue | $200K-$400K |

| Dispute/chargeback fees | $15-$25 per dispute | $6K-$15K |

| Integration maintenance | Developer time | $12K-$24K |

| Total | $498K-$879K |

Stripe: The Developer's Choice

Stripe launched in 2010 with a mission: make online payments simple for developers. That focus shows in every aspect of the platform.Core Strengths

- Exceptional API Design

- Basic integration: 2-3 days

- Advanced features (subscriptions, Connect): 1-2 weeks

- Multi-currency: Additional 1-2 days

- Comprehensive Payment Method Support

- Credit/debit cards (Visa, Mastercard, Amex, Discover)

- Digital wallets (Apple Pay, Google Pay, Microsoft Pay)

- Buy-now-pay-later (Klarna, Affirm, Afterpay/Clearpay)

- Alipay, WeChat Pay (China)

- Bancontact, iDEAL, Sofort (Europe)

- SEPA Direct Debit (Europe)

- ACH Direct Debit (US)

- BECS Direct Debit (Australia)

- Strong Fraud Protection

- Blocks 99.9% of fraudulent transactions

- False positive rate: Under 1%

- Customizable rules (block high-risk countries, velocity limits)

- No additional cost (included in transaction fees)

Pricing Structure

Standard pricing (most merchants):- 2.9% + 30¢ per successful card charge (US)

- 3.4% + 30¢ per successful card charge (international cards)

- 0.8% additional for currency conversion

- Starts around 2.5% + 20¢

- Can go as low as 2.2% at very high volumes

| Transaction Type | Volume | Rate | Cost |

| US cards | $6M | 2.9% + 30¢ | $175,200 |

| International cards | $2M | 3.4% + 30¢ | $69,000 |

| Currency conversion | $2M | 0.8% | $16,000 |

| Total | $10M | $260,200 |

Stripe's Multi-Currency Implementation

Stripe handles multi-currency in two ways: Option 1: Presentment Currency Charge customer in their local currency, receive settlement in your account currency. Stripe handles conversion with 1% markup. Workflow:- UK customer sees £100 price

- UK customer pays £100

- Stripe converts £100 to $130 USD (example rate)

- You receive $129 USD (after 1% conversion fee)

- UK customer sees £100 price

- UK customer pays £100

- You receive £100 directly in UK bank account

Where Stripe Struggles

Limited enterprise features: No advanced fraud management UI, basic reporting compared to Adyen, less sophisticated chargeback management. Higher rates for high volume: At $50M+ annually, enterprise processors offer better rates. Support quality: Email-based support can be slow for urgent payment issues (no dedicated account managers until very high volumes).PayPal: The Trusted Brand

PayPal has 430+ million active accounts globally. That installed base makes PayPal a must-have for many merchants.Core Strengths

- Consumer Trust and Recognition

| Customer Type | With PayPal | Without PayPal | Improvement |

| First-time visitors | 2.1% conversion | 1.6% conversion | +31% |

| Returning customers | 3.8% conversion | 3.7% conversion | +3% |

- Buyer Protection Program

- One-Click Checkout

- Manual card entry: 90-120 seconds

- PayPal Express: 15-25 seconds

- Manual checkout: 68%

- PayPal Express: 42%

Pricing Structure

Standard rates:- 2.9% + 30¢ per transaction (US domestic)

- 4.4% + fixed fee (international transactions)

- 1.5% currency conversion fee

| Scenario | Rate | Fee on $100 |

| US customer, US merchant | 2.9% + 30¢ | $3.20 |

| UK customer, US merchant | 4.4% + 30¢ | $4.70 |

| UK customer, UK merchant | 3.4% + 20p | £3.60 |

| Currency conversion (£ to $) | +1.5% | Additional $1.50 |

| Component | Cost |

| US domestic transactions (60%) | $192,000 |

| International transactions (40%) | $184,000 |

| Currency conversion | $60,000 |

| Total | $436,000 |

PayPal's Multi-Currency Approach

PayPal supports 200+ countries and 25 currencies through:- PayPal Checkout: Customer pays in any supported currency. You receive settlement in your account currency.

- Multi-Currency Balance: Hold balances in multiple currencies. Useful if you have expenses in those currencies.

- PayPal Commerce Platform: More sophisticated integration with better reporting and webhooks (launched 2021, addressing past API limitations).

Where PayPal Struggles

High international fees: 4.4% on cross-border transactions is expensive compared to Stripe (3.4%) and Adyen (2.8%). Account holds/freezes: PayPal is notorious for freezing merchant accounts during disputes, holding funds for weeks. Poor developer experience: APIs historically weak (improving with Commerce Platform), webhook reliability issues, difficult error handling. Chargeback bias: PayPal heavily favors buyers in disputes. Merchants often lose even with evidence. Real story: A client had $45K frozen for 3 weeks during holiday season due to "suspicious activity" (sales spike from successful marketing campaign). Nearly destroyed their business.Adyen: The Enterprise Platform

Adyen powers payments for Uber, Spotify, Microsoft, eBay, and hundreds of enterprise companies. It's built for scale, complexity, and global operations.Core Strengths

- Unified Platform

- Online checkout

- Mobile apps (in-app payments)

- Point-of-sale (physical stores)

- Marketplaces (platform payments)

- Superior Authorization Rates

- Smart routing (send transaction to best-performing acquirer)

- Network tokens (replace card numbers with tokens, higher approval rates)

- Local acquiring (process transactions locally in each market)

| Processor | Authorization Rate (US) | Authorization Rate (International) |

| Stripe | 96.2% | 93.8% |

| PayPal | 97.1% | 94.2% |

| Adyen | 97.8% | 96.4% |

- Transparent Interchange-Plus Pricing

- Actual interchange fees (what Visa/Mastercard charge)

- Plus fixed markup (your margin to Adyen)

- Visa interchange: 1.65% + 10¢

- Adyen markup: 0.60% + 5¢

- Total: 2.25% + 15¢

- Advanced Reporting and Analytics

- Authorization rate by card type, country, time of day

- Decline reason analysis (expired cards, insufficient funds, fraud)

- Settlement reconciliation across currencies

- Revenue optimization recommendations

Pricing Structure

Interchange-plus model:- Interchange: 1.5-2.5% (varies by card type)

- Adyen markup: 0.6% + €0.10 (negotiable at volume)

- Typical total: 2.1-3.1%

| Component | Cost |

| Interchange fees | $190,000 |

| Adyen markup (0.6%) | $60,000 |

| Per-transaction fees | $12,000 |

| Monthly minimum | $3,000 |

| Total | $265,000 |

Adyen's Multi-Currency Excellence

Adyen excels at international commerce through:- Local Acquiring: Process transactions in-country (better authorization rates, lower fees).

- Dynamic Currency Conversion (DCC): Let customers pay in their home currency while you receive your settlement currency.

- Multi-Currency Settlement: Receive payouts in 30+ currencies.

- 250+ Payment Methods: Extensive local payment method support (Alipay, WeChat, iDEAL, Swish, MobilePay, Pix, etc.).

Where Adyen Struggles

High barrier to entry: Minimum volumes typically $2M-$5M annually. Below this, they may decline or charge higher rates. Complex setup: Integration takes 4-8 weeks (vs 2-3 days for Stripe). Requires technical sophistication. Steeper learning curve: More complex than Stripe. Documentation good but assumes higher technical knowledge. Not cost-effective for small businesses: Monthly minimums and platform complexity make Adyen overkill for businesses under $5M revenue.Head-to-Head Comparison

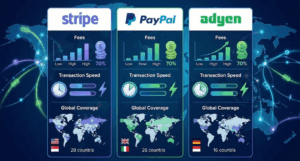

Transaction Costs (at $10M annual revenue)

| Gateway | US Domestic | International | Currency Conversion | Total Annual Cost |

| Stripe | 2.9% + 30¢ | 3.4% + 30¢ | 1% | $260K |

| PayPal | 2.9% + 30¢ | 4.4% + 30¢ | 1.5% | $436K |

| Adyen | 2.2% + 15¢ | 2.8% + 15¢ | 0.6% | $265K |

- Stripe saves: $176K annually (40% reduction)

- Adyen saves: $171K annually (39% reduction)

Payment Method Coverage

| Region | Stripe | PayPal | Adyen |

| Credit/Debit Cards | ✅ Excellent | ✅ Excellent | ✅ Excellent |

| Digital Wallets | ✅ Apple/Google Pay | ✅ PayPal + others | ✅ All major wallets |

| Buy-Now-Pay-Later | ✅ Good (Klarna, Affirm) | ✅ PayPal Pay Later | ✅ Excellent (all providers) |

| Local Payment Methods | ⚠️ Growing | ⚠️ Limited | ✅ 250+ methods |

| Bank Transfers | ✅ ACH, SEPA | ⚠️ Limited | ✅ Extensive |

Authorization Rates

| Gateway | US Cards | International Cards | Revenue Lost to Failures |

| Stripe | 96.2% | 93.8% | $100K (at $10M) |

| PayPal | 97.1% | 94.2% | $80K |

| Adyen | 97.8% | 96.4% | $48K |

Developer Experience

| Feature | Stripe | PayPal | Adyen |

| API quality | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ |

| Documentation | ⭐⭐⭐⭐⭐ | ⭐⭐⭐ | ⭐⭐⭐⭐ |

| Integration speed | 2-3 days | 1-2 days | 4-8 weeks |

| Testing tools | Excellent | Good | Excellent |

| SDKs/Libraries | 15+ languages | 10+ languages | 12+ languages |

Decision Framework

Choose Stripe If:

- You're processing under $5M annually

- Developer experience and speed to market are priorities

- You need flexibility to start small and scale

- You want excellent documentation and community support

- You're selling primarily in US, UK, EU, Australia

Choose PayPal If:

- PayPal brand recognition significantly increases your conversion

- You're selling primarily to consumers (not B2B)

- You're processing mostly domestic transactions

- Your average order value is under $50 (PayPal's fixed fees matter less)

- You want to offer PayPal Credit/Pay Later financing

Choose Adyen If:

- You're processing $5M+ annually

- International sales are significant (30%+ of revenue)

- Authorization rate improvements justify complexity

- You need omnichannel (online + mobile + in-store)

- You want enterprise-grade reporting and support

- You're expanding to markets with local payment methods

The Hybrid Strategy

Many successful merchants use multiple processors strategically: Primary processor (80% of volume): Stripe or Adyen Secondary processor (20% of volume): PayPal Why this works:- Offer PayPal for customers who prefer it (captures PayPal-only shoppers)

- Use Stripe/Adyen for card payments (better rates, better control)

- Redundancy (if one processor has issues, the other continues working)

Key Takeaways

- Stripe best for growing businesses under $5M revenue (excellent developer experience, fair pricing, comprehensive features)

- PayPal essential for consumer trust but expensive for international (use alongside Stripe/Adyen, not as sole processor)

- Adyen wins for enterprises processing $5M+ with international sales (best authorization rates, lowest costs at scale)

- Payment costs vary 40-60% between best and worst gateway choice ($260K vs $436K at $10M revenue)

- Authorization rates matter more than fees for some businesses (1% authorization improvement = $100K recovered revenue)

- Multi-currency requires local payment methods not just currency display (iDEAL in Netherlands, Afterpay in Australia)

- Hybrid strategy captures best of all platforms (use multiple processors for different payment methods)

How Askan Technologies Optimizes Payment Processing

As an ISO-9001 certified development partner, we've integrated Stripe, PayPal, and Adyen across 40+ eCommerce implementations processing $2M to $50M annually. Our Payment Integration Services:- Gateway Selection Consulting: Analyze transaction patterns and recommend optimal processor(s)

- Multi-Gateway Implementation: Integrate multiple processors with smart routing

- Payment Optimization: A/B test payment flows, optimize authorization rates

- Multi-Currency Setup: Configure currency presentation, settlement, and tax calculation

- PCI Compliance: Ensure secure payment handling meeting all requirements

- Fashion retailer: Hybrid Stripe + PayPal setup, $8K monthly savings vs PayPal-only

- Electronics store: Adyen integration, 2.3% authorization rate improvement = $180K recovered revenue

- B2B platform: Stripe with ACH, reduced payment processing costs 48%

Stripe vs PayPal vs Adyen: Payment Gateway Selection for Multi-Currency eCommerce

Payment processing is the only technology decision where every percentage point directly impacts your bottom...

Share this link via

Or copy link